By now many of you will have heard about the Government’s Economic Stimulus Package announced yesterday in response to the COVID-19 outbreak.

Package Aims

- Support business investment;

- Provide cash flow assistance to help small and medium sized business to stay in business and keep their employees in jobs;

- Support the most severely affected sectors, regions and communities; and

- Provide household stimulus payments that will benefit the wider economy.

How is this Achieved?

INCREASING THE INSTANT ASSET WRITE-OFF

The instant asset write-off threshold has been increased to $150,000 for businesses with aggregated turnover less than $500M. The write-off is currently available until 30 June 2020 so businesses that may be needing to invest in large items of plant & equipment would be encouraged to consider bringing forward this investment.

BACKING BUSINESS INVESTMENT (BBI)

Businesses with a turnover of less than $500 million will be able to deduct 50 per cent of the asset cost in the year of purchase then depreciate the balance as normal. This will apply to eligible new assets that are depreciable under Div 40 and are installed ready for use before 30 June 2021.

BOOSTING CASH FLOW FOR EMPLOYERS

Small and medium business entities with aggregated annual turnover under $50 million and that employ workers will be eligible for a tax free government payment of between $2,000 to $25,000.

Eligible businesses that withhold tax to the ATO on their employees’ salary and wages will receive a payment equal to 50 per cent of the amount withheld up to the $25,000 threshold, which will be delivered as a credit on their activity statements.

Business who employ workers but are not required to withhold will receive the minimum $2,000 payment.

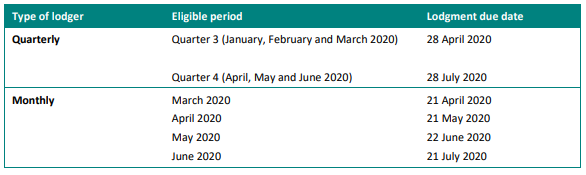

The 50% calculation applies to the following activity statements:

SUPPORTING APPRENTICES AND TRAINEES

Small businesses employing fewer than 20 full-time employees who retain an apprentice or trainee, who was in training as at 1 March 2020, will be eligible for a wage subsidy of 50 per cent of the apprentice’s or trainee’s wage paid during the 9 months from 1 January 2020 to 30 September 2020.

Employers will be reimbursed up to a maximum of $21,000 per eligible apprentice or trainee ($7,000 per quarter).

Employers can register for the subsidy from early-April 2020. Final claims for payment must be lodged by 31 December 2020.

STIMULUS PAYMENTS

The Government will provide a one-off tax-free $750 payment to around 6.5 million social security, veteran and other income support recipients and eligible concession card holders. Around half of those that benefit are pensioners. This payment will help to support confidence and domestic demand in the economy. The payment will not count toward the income test.

To be eligible, you must be residing in Australia and be receiving one of the following payments or hold one of the following concession cards on March 12 2020:

- Age Pension

- Disability Support Pension

- Carer Payment

- Parenting Payment

- Wife Pension

- Widow B Pension

- ABSTUDY (Living Allowance)

- Austudy

- Bereavement Allowance

- Newstart Allowance

- Youth Allowance

- Partner Allowance

- Sickness Allowance

- Special Benefit

- Widow Allowance

- Family Tax Benefit, including Double Orphan Pension

- Carer Allowance

- Pensioner Concession Card holders

- Commonwealth Seniors Health Card holders

- Veteran Service Pension; Veteran Income Support Supplement; Veteran Compensation payments; including lump sum payments; War Widow(er) Pension; and Veteran Payment

- Veteran Gold Card holders

- Farm Household Allowance

The one-off payment will be paid automatically from 31 March 2020 by Services Australia or the Department of Veterans’ Affairs. Over 90 per cent of payments will be made by mid-April 2020.

SUPPORT FOR CORONAVIRUS-AFFECTED REGIONS AND COMMUNITIES

A $1B fund has been established for regions and communities most significantly affected by the virus outbreak. This includes regions heavily reliant on industries such as tourism, agriculture and education. We would expect Tweed and Byron, and the Gold Coast to be included however are awaiting further details.

The Australian Tax Office (ATO) is also providing administrative relief for some tax obligations for people affected by the Coronavirus outbreak, on a case-by-case basis. If your business is affected please contact our office to discuss administrative assistance.

What Should I Do?

If you think you might be eligible or just want to know more, please reach out to our team and we will be able to assist you.

Nick Moran